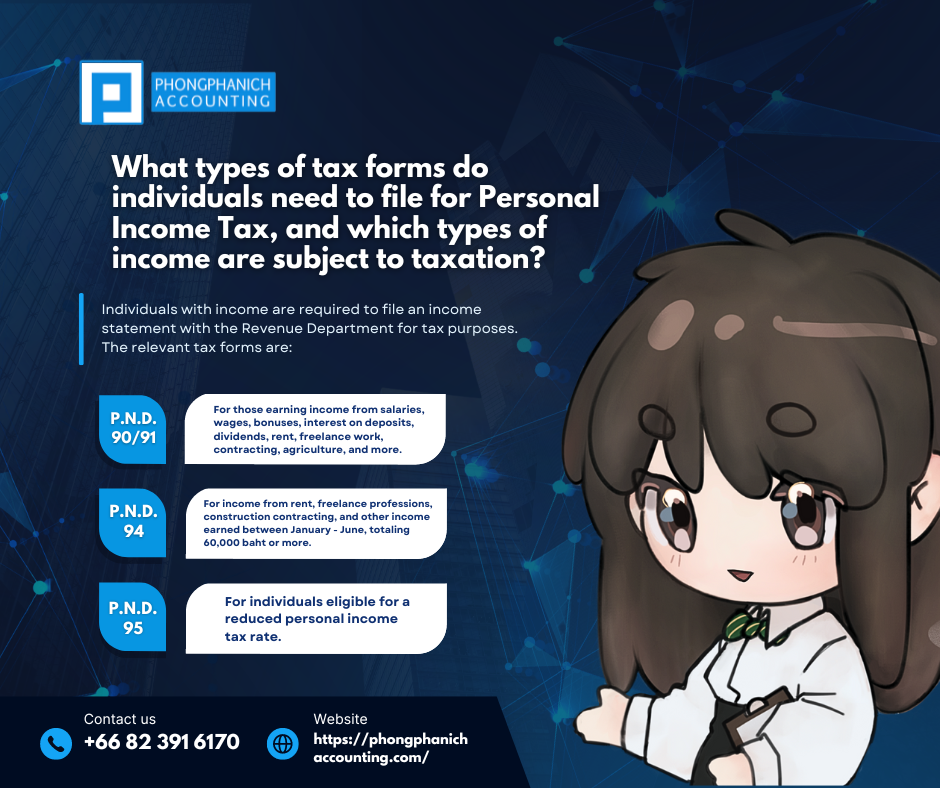

Individuals with income are required to file an income statement with the Revenue Department for tax purposes. The relevant tax forms are:

– P.N.D. 90/91: For those earning income from salaries, wages, bonuses, interest on deposits, dividends, rent, freelance work, contracting, agriculture, and more.

– P.N.D. 94: For income from rent, freelance professions, construction contracting, and other income earned between January and June, totaling 60,000 baht or more.

– P.N.D. 95: For individuals eligible for a reduced personal income tax rate.

To ensure fairness in tax calculation methods, the law categorizes income (assessable income) into various groups, reflecting the diversity and complexity of different professions. The classifications are as follows:

Types of Income Subject to Taxation

#Type 1 Income: Income from employment, which includes:

• Salaries, wages, allowances, bonuses, pensions, and severance pay.

• Housing allowances provided by the employer.

• The value of living in a house supplied by the employer without rent.

• Payments made by the employer for debts the employee is obligated to settle.

• Any benefits or properties received from employment, such as the value of provided meals.

#Type 2 Income: Income from duties or positions held, or from freelance work, which includes:

• Fees, commissions, and discounts.

• Compensation for work performed, meeting allowances, and bonuses.

• Housing allowances associated with the position held.

• The value of living in a house provided without rent due to employment.

• Payments made for debts the individual is required to pay.

• Any benefits or properties received from duties or positions, whether permanent or temporary.

#Type 3 Income: Goodwill payments, royalties, or other rights, as well as annual income from wills, legal actions, or court rulings.

#Type 4 Income: Interest, dividends, profit shares, capital reductions, capital increases, and benefits from share transfers, including:

• Interest from bonds, deposits, debentures, and loans, regardless of collateral.

• Dividends or profit shares from corporations, partnerships, mutual funds, or financial institutions established under Thai law for lending.

• Bonuses paid to shareholders or partners in a corporation or partnership.

• Capital reductions or increases from retained profits.

• Benefits from corporate mergers or divisions valued above capital.

• Benefits from transferring partnership interests or shares, provided they exceed the initial investment.

In many cases, the law allows taxpayers to choose withholding tax instead of including it in overall income for calculation, potentially leading to tax savings for those who would otherwise face a higher tax rate.

#Type 5 Income: Income from property rental or other benefits derived from:

• Renting property.

• Breaches of lease agreements.

• Breaches of installment sales where the seller retrieves the sold property without refunding the payment or benefits received.

#Type 6 Income: Income from independent professions, such as law, medical services, engineering, architecture, accounting, fine arts, or any other profession specified by royal decree.

#Type 7 Income: Income from contracting, where the contractor is required to invest in significant materials beyond just tools.

#Type 8 Income: Income from businesses, commerce, agriculture, industry, transportation, real estate sales, or any other activities not specified in Types 1 through 7.