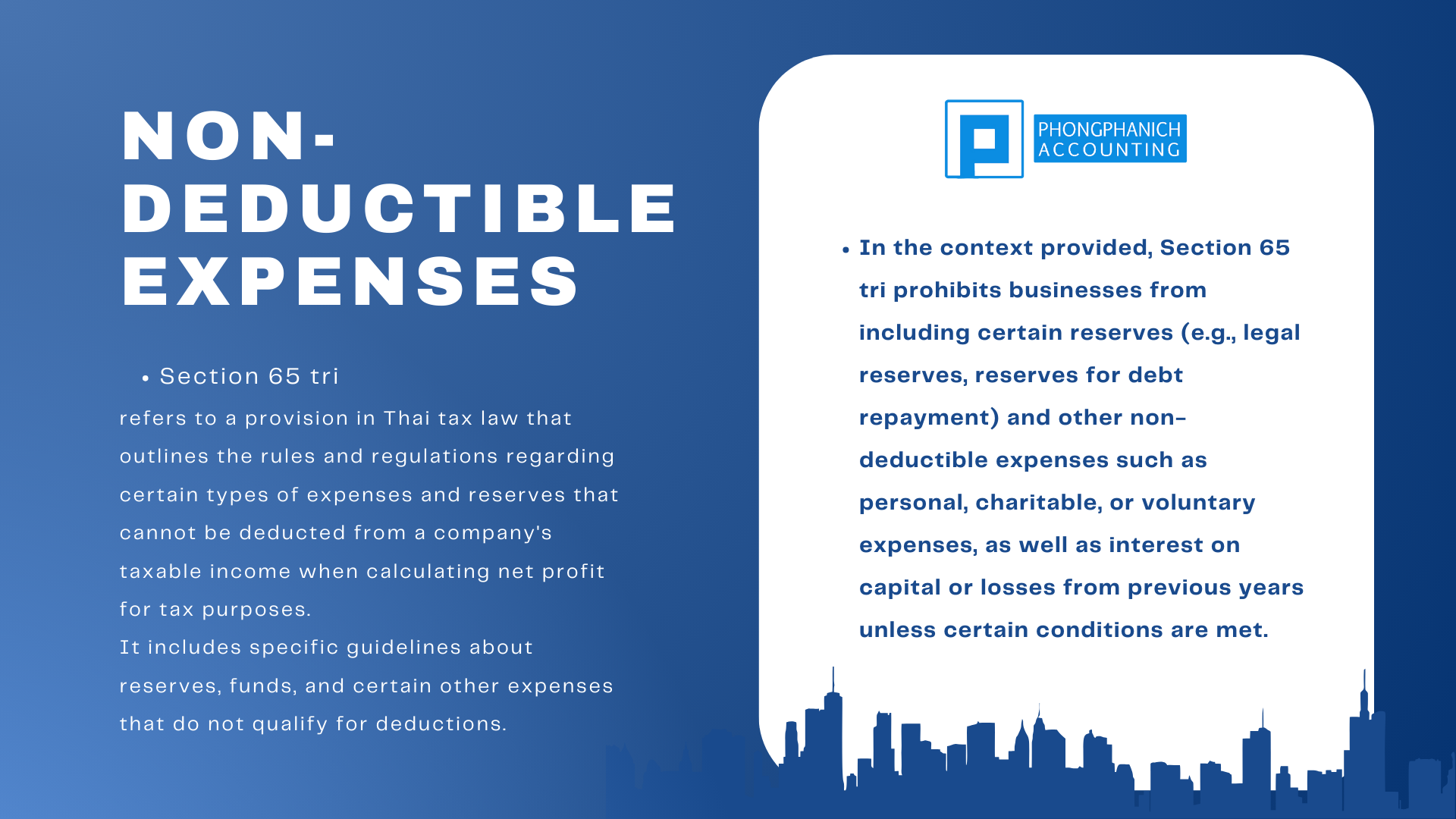

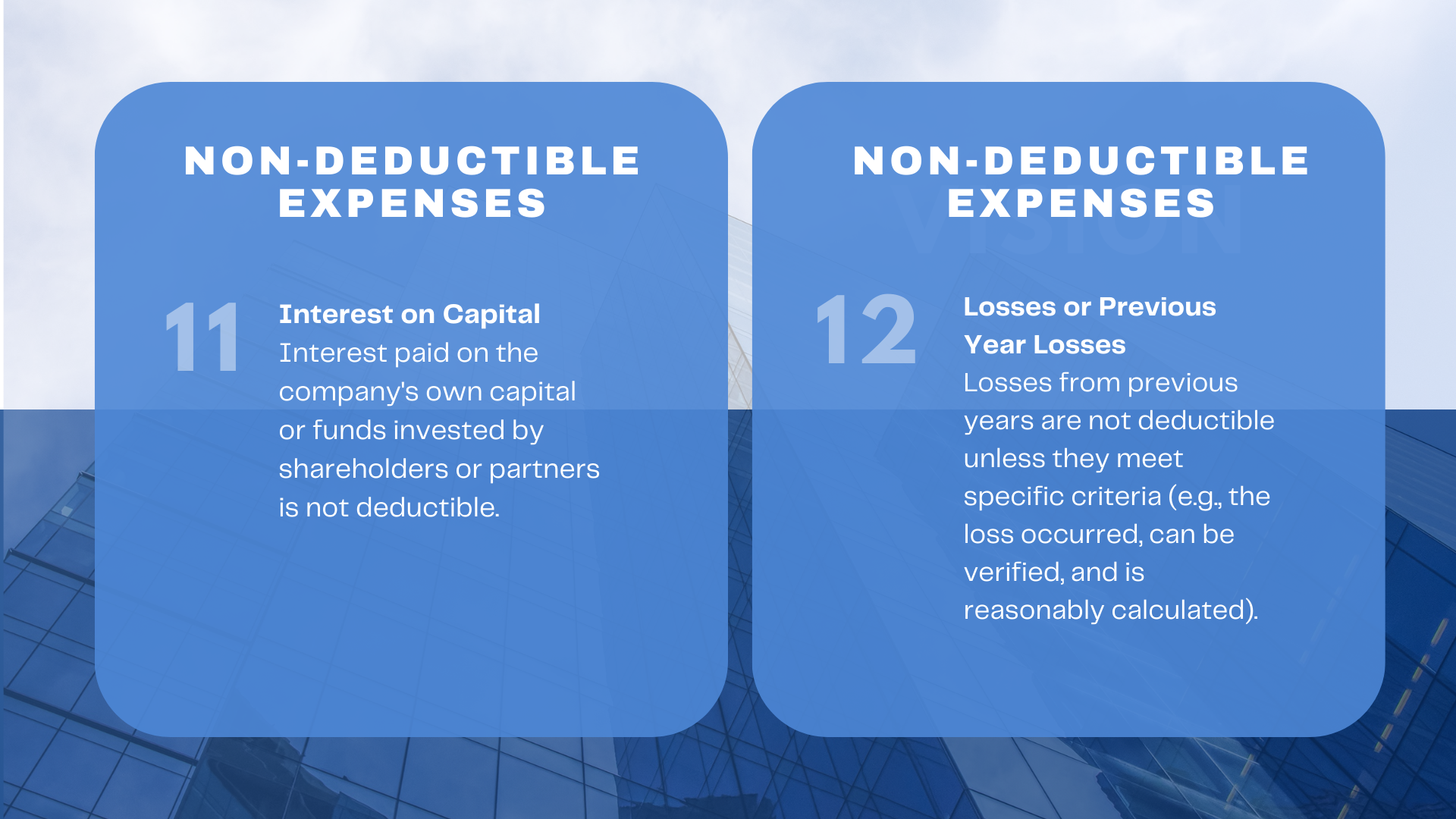

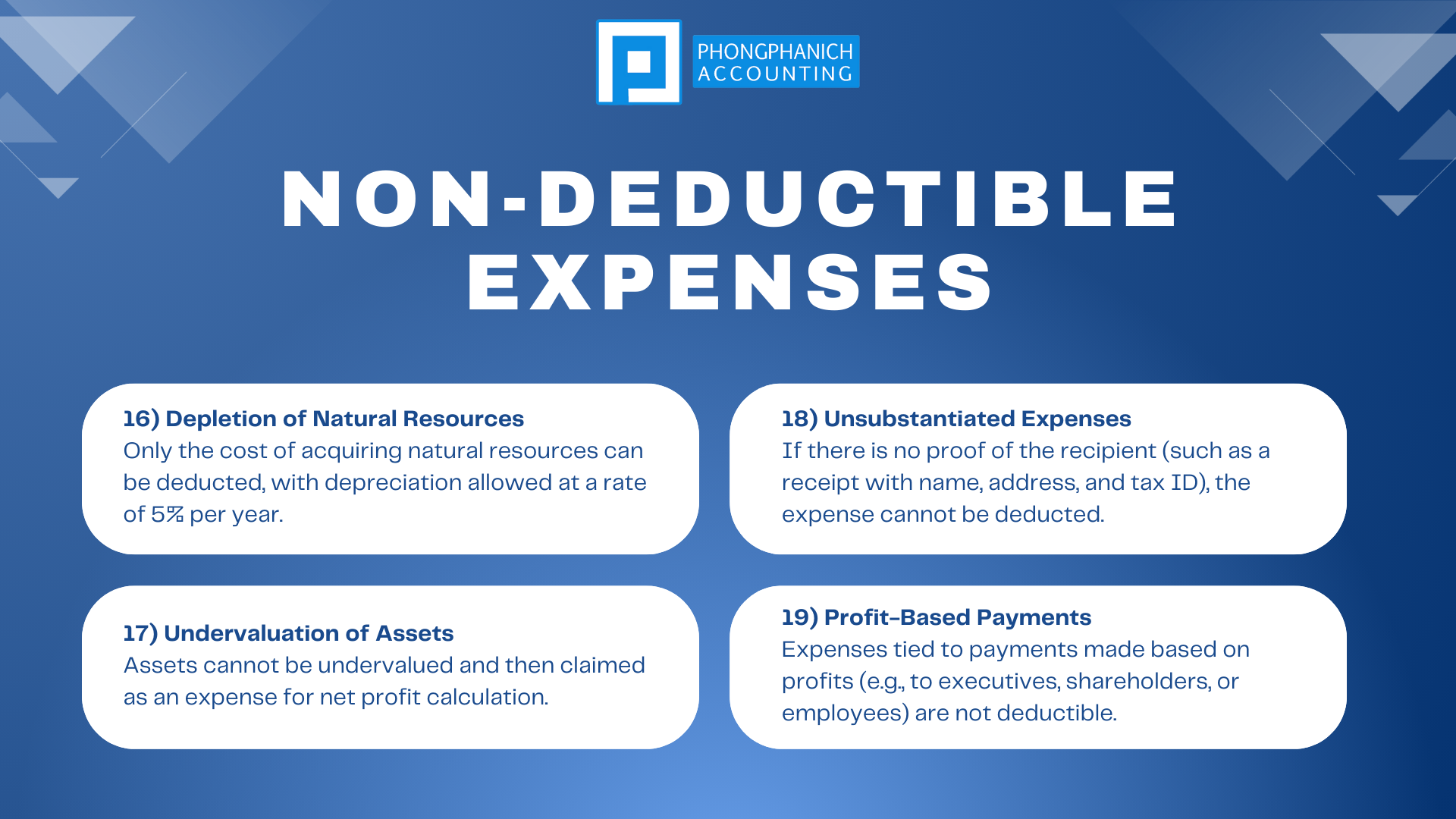

Based on the documents I receive monthly for bookkeeping and tax filing, I have found that several businesses have items categorized as prohibited expenses, which cannot be deducted when calculating net profit for tax purposes. In some cases, these prohibited expenses can be as high as 80%.

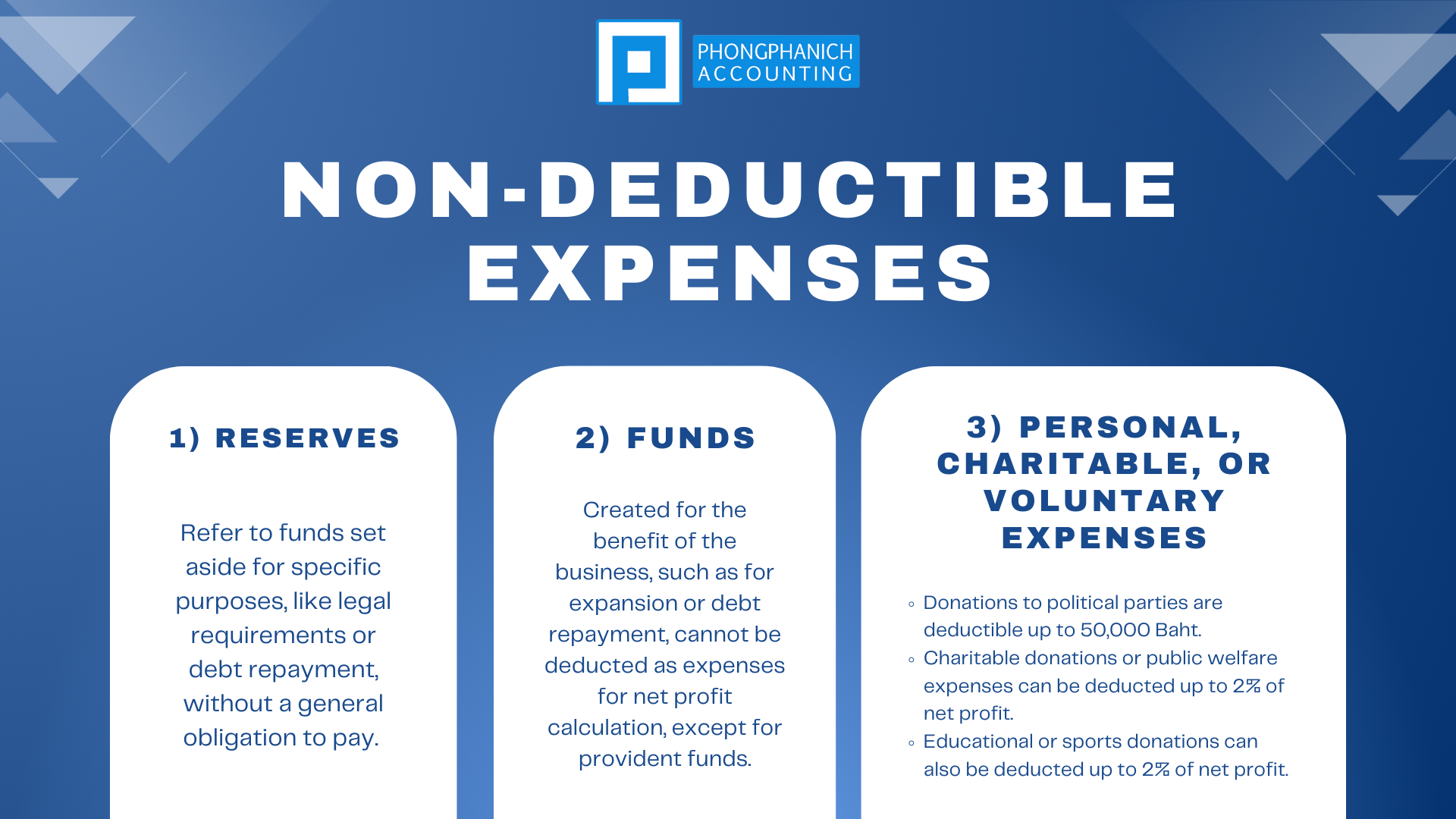

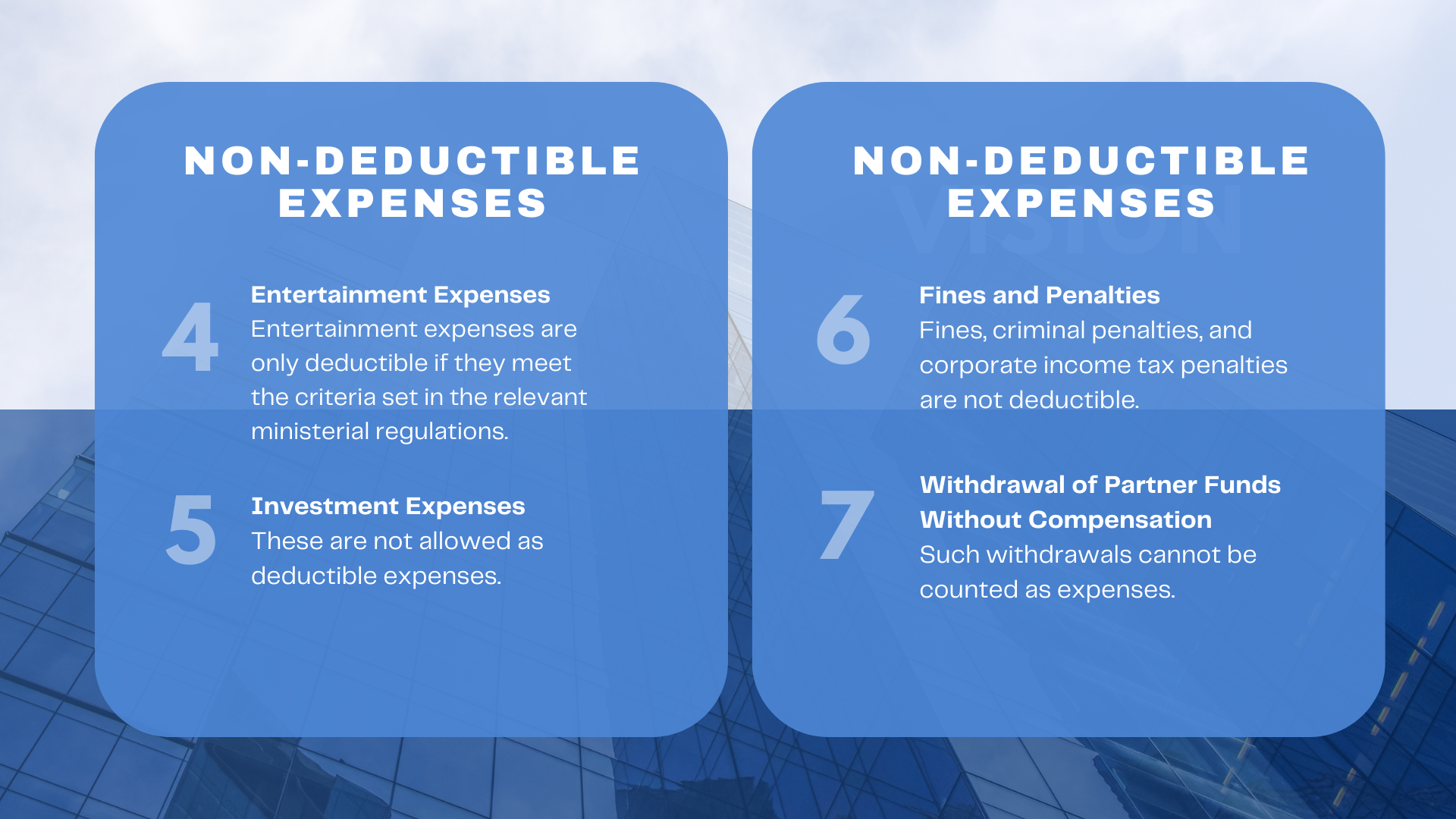

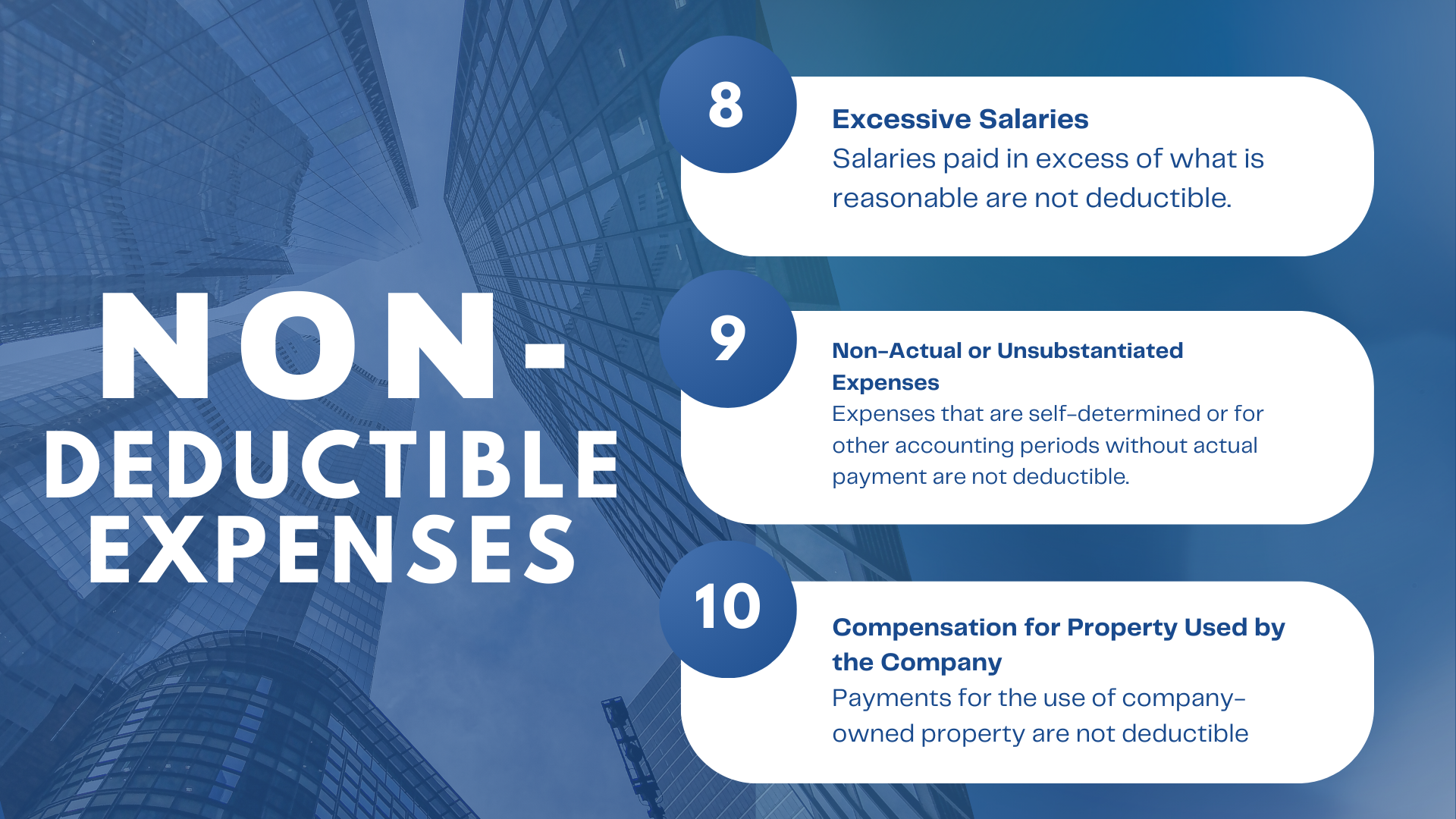

To help clarify, I have summarized the key information for business owners in an easy-to-understand format, as shown in the image. While there are many details about Non-deductible expenses, in short, there are 19 types of prohibited expenses, as illustrated in the image.