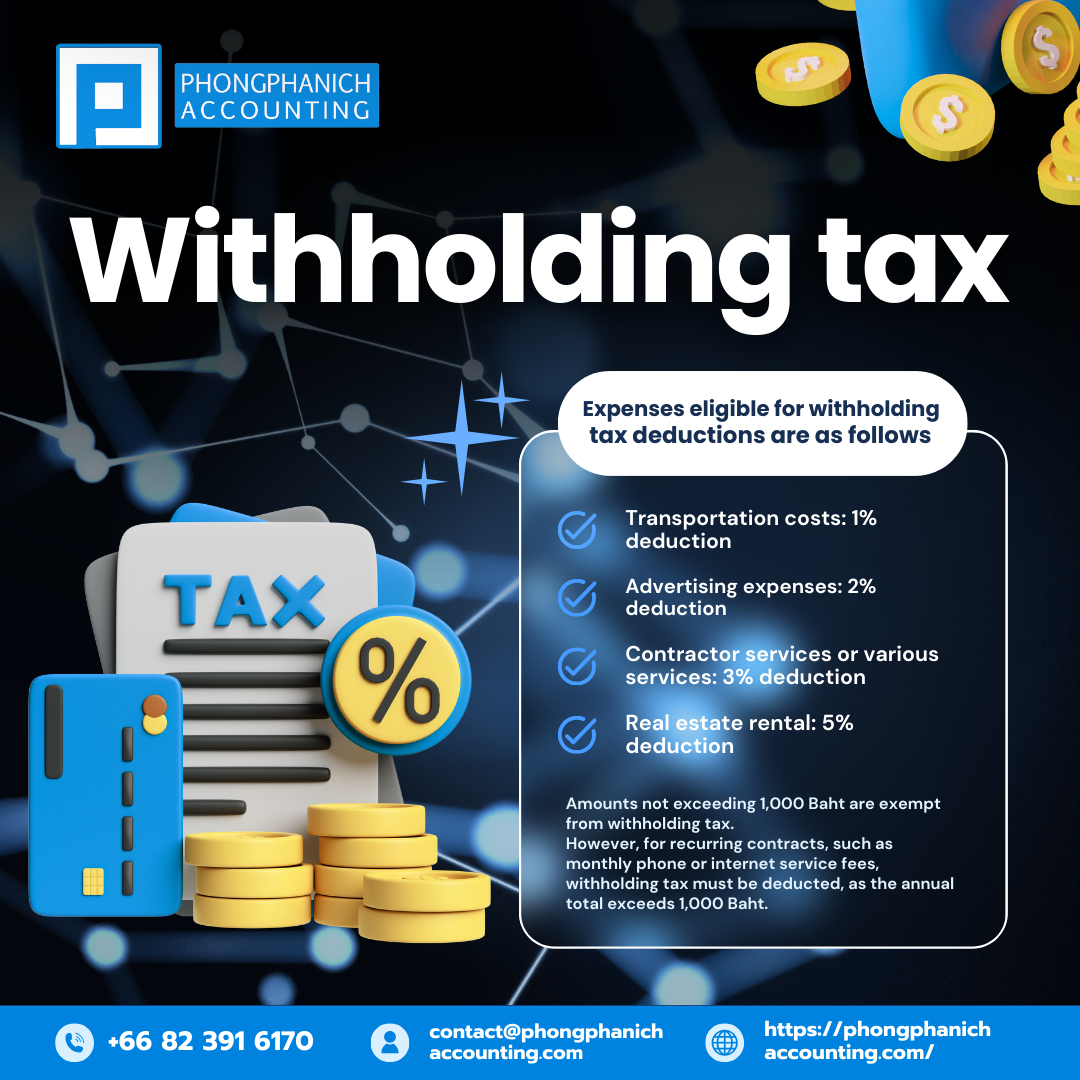

Withholding tax in Thailand applies to payments made to contractors, service providers, or subcontractors for amounts of 1,000 Baht or more. A specified withholding tax must be deducted from these payments. Amounts that do not exceed 1,000 Baht are exempt from withholding tax. However, for ongoing contracts, such as monthly fees for phone or internet services, withholding is required since the total could exceed 1,000 Baht over the year.

According to the law, withholding taxes, known as PND 3 for individuals and PND 53 for entities, must be submitted by the 15th of each month. If the 15th falls on a holiday, the Revenue Department will extend the deadline. It’s crucial to check the Revenue Department’s calendar to know the last submission day each month to avoid late filings and penalties.

Common Types of Income Subject to Withholding Tax

#1% – Transportation Costs: Payments of 1,000 Baht or more for transportation of goods or services incur a 1% withholding tax.

#2% – Advertising Expenses: A 2% withholding tax is deducted for payments made for advertising in print or online media.

#3% – Various Services: Different withholding tax rates apply for payments for services, such as 3% for contracted services. This also includes income from freelance professions under Section 40(6) of the Revenue Code, such as medical, engineering, architecture, accounting, and fine arts.

#5% – Real Estate Rental: A 5% withholding tax applies to leasing buildings or land, except for boat rentals under the Maritime Commerce Promotion Act, which incurs a 1% deduction.

#5% – Prizes, Contests, Competitions, and Lotteries: A 5% withholding tax is deducted for these payments.

#Tax Submission

After withholding the tax, the payer must submit the deducted amount to the Revenue Department within the designated timeframe. This typically involves monthly submissions, requiring the completion of forms and timely payment of taxes.

Withholding tax is an essential process for tax management in Thailand, allowing the government to collect revenue for national development while also helping to curb tax evasion by businesses. It is vital for stakeholders to fully understand the regulations and requirements to avoid future complications.

#WithholdingTax #TaxFiling in Thailand.